NEW PEER TO PEER LENDING REGULATION ON INFORMATION TECHNOLOGY-BASED CO-FINANCING SERVICES

BY : Tika Ramayanti, SH; and Kenny Anggara Manurung, SH.

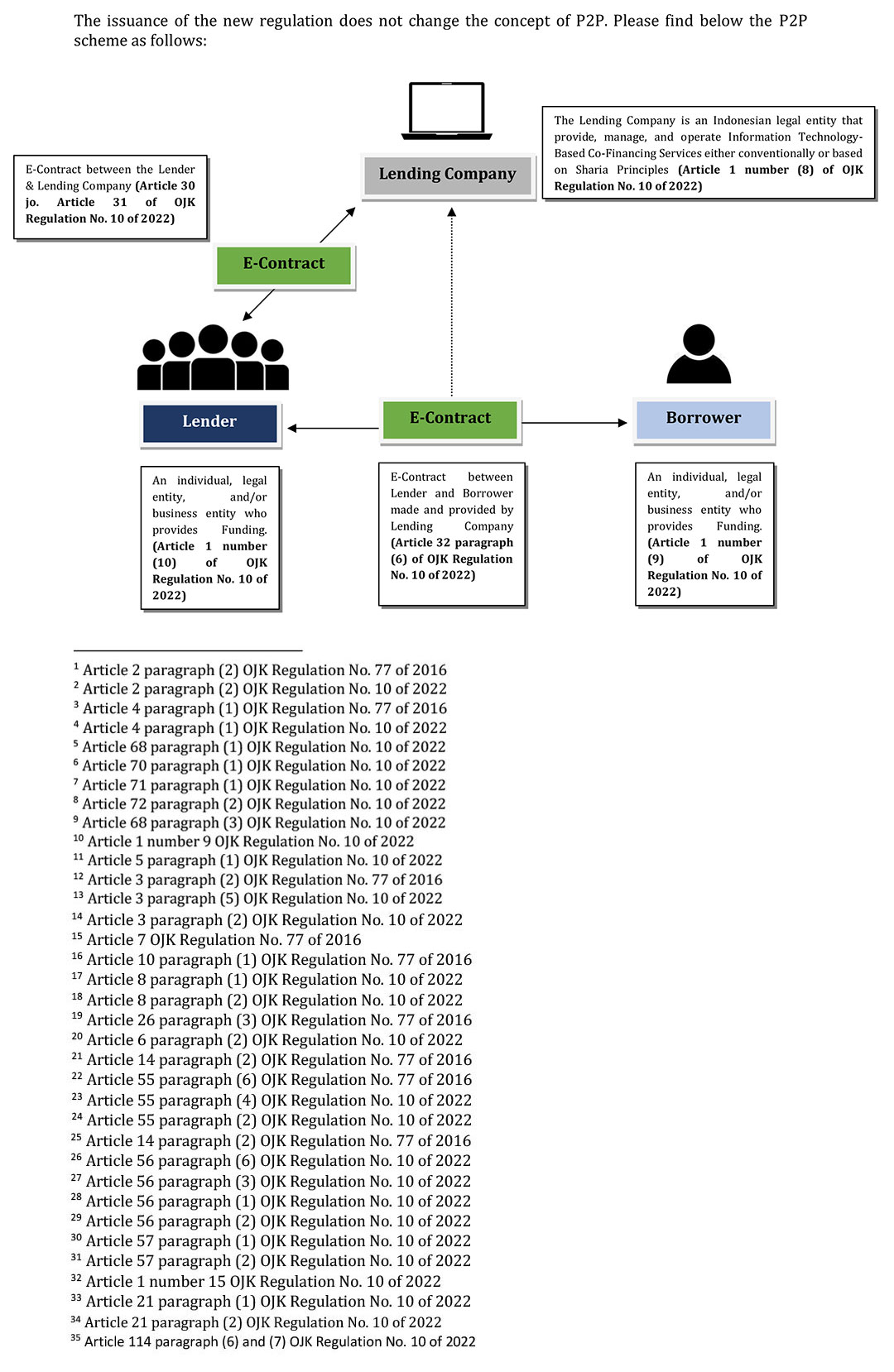

The financial technology sector in Indonesia is growing rapidly which simultaneously promote the increase of illegal online lending. On 4 July 2022, the Indonesian Financial Services Authority (Otoritas Jasa Keuangan) ("OJK") issued a new regulation in relation to online Peer to Peer Lending ("P2P"), concerning Information Technology-Based Co-Financing Services under OJK Regulation Number 10 of 2022 ("OJK Regulation No. 10 of 2022"). The issuance of this OJK Regulation No. 10 of 2022 is also a move to help clean up the booming online lending sector invaded by consumer complaints.

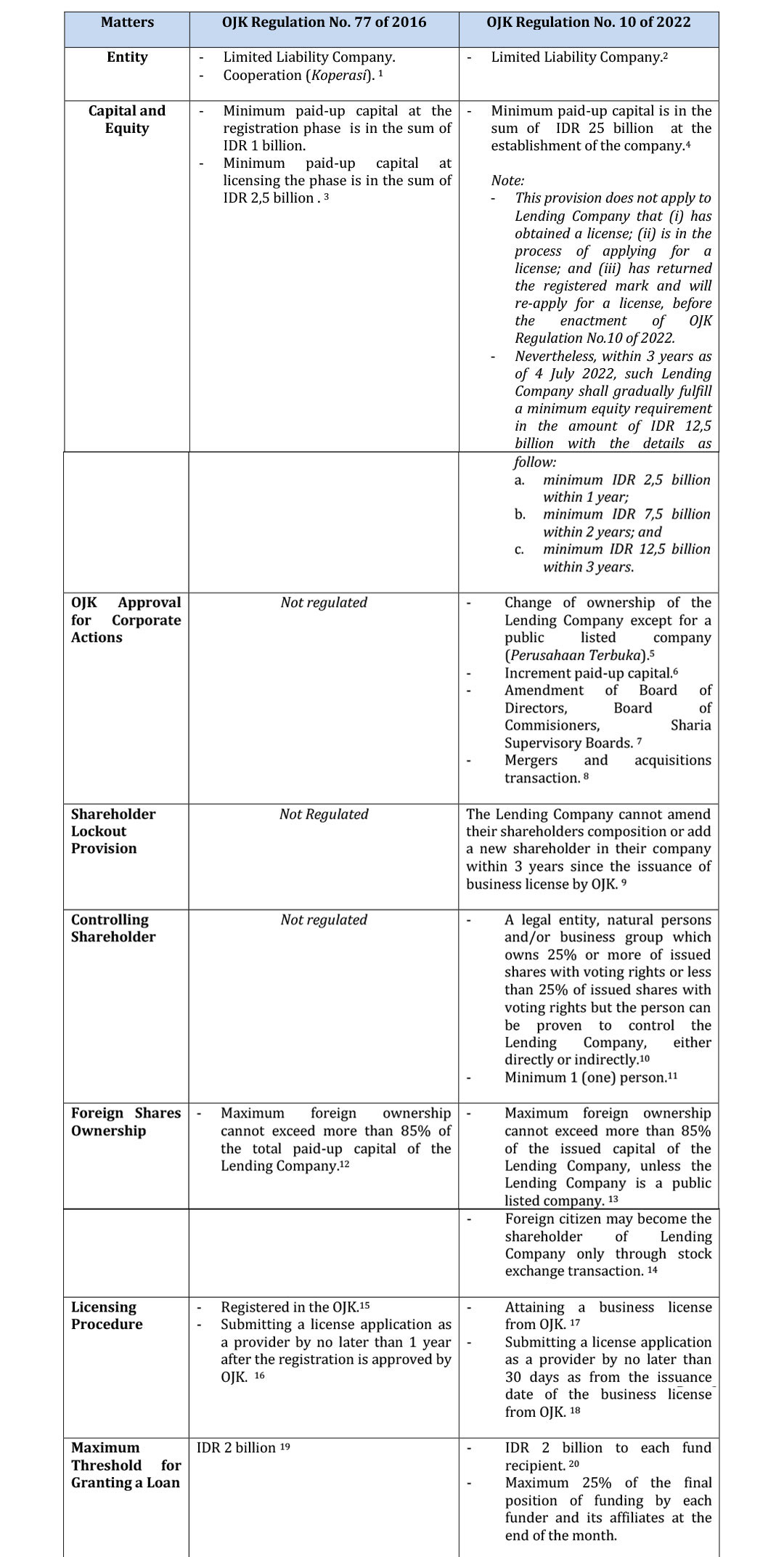

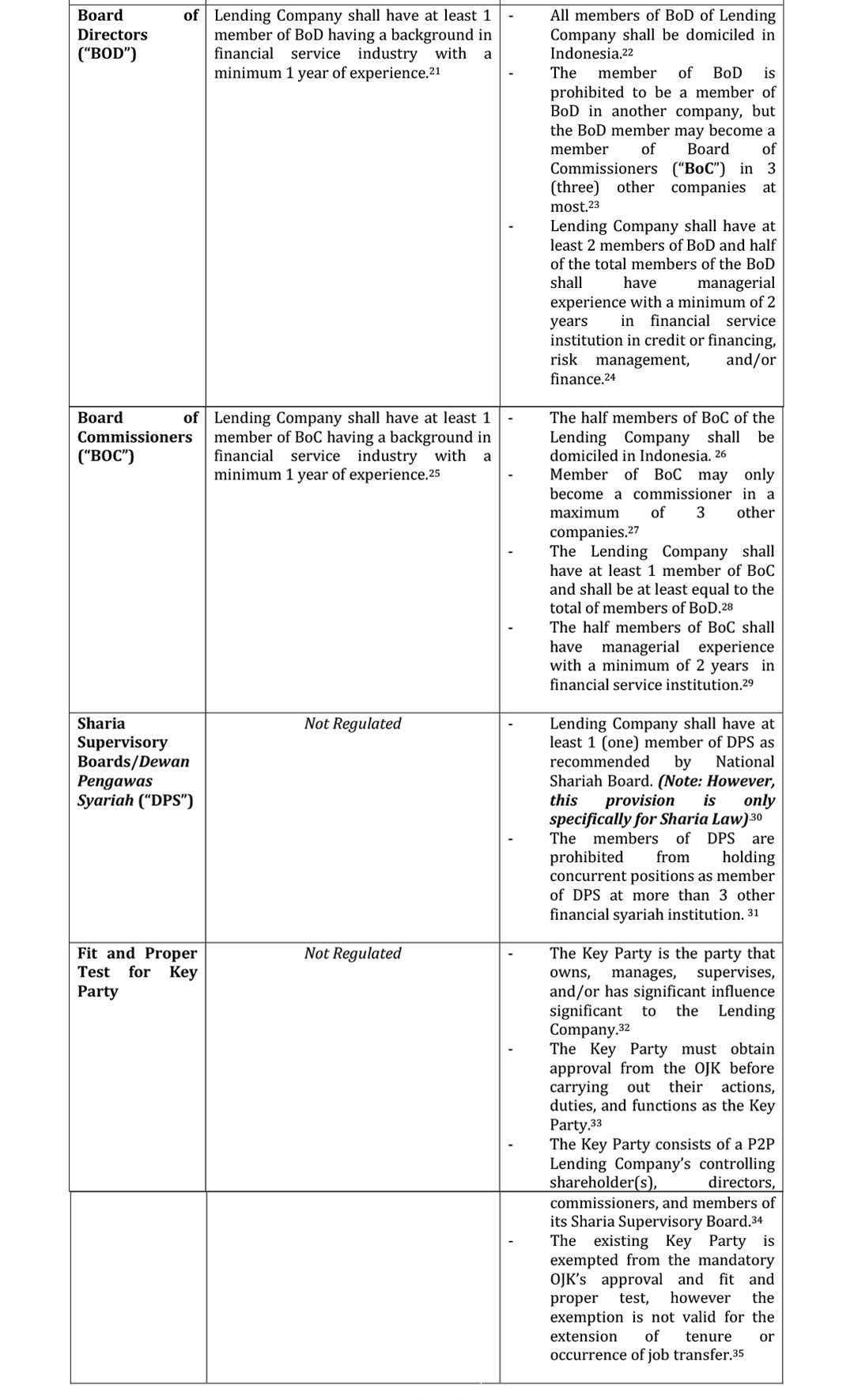

Subsequently, the OJK Regulation No. 10 of 2022 revokes the OJK Regulation Number 77 of 2016 on Technology-Based Lending Services ("OJK Regulation No. 77 of 2016") and stipulates more comprehensive and detailed provisions as compared to OJK Regulation No. 77 of 2016 for P2P Company ("Lending Company").

In addition, there are several provisions for Lending Company to operate as a Co-Financing services platform and to provide P2P services. The key matters in OJK Regulation No. 10 of 2022 compared to OJK Regulation No. 77 of 2016 are as follows: